The Nvidia price has become one of the most talked-about topics in the financial world. As a global leader in graphics processing units (GPUs), artificial intelligence (AI), and data center technologies, Nvidia has seen its stock skyrocket over the past few years. Investors, traders, and tech enthusiasts alike are closely watching every move the company makes — from product launches to earnings reports — to predict how the Nvidia price might move next.

In this article, we’ll break down the current state of Nvidia’s stock price, the key factors influencing it, and what analysts are saying about its future performance.

What Is Nvidia?

Founded in 1993, Nvidia Corporation (NASDAQ: NVDA) began as a graphics card manufacturer catering mainly to gamers. Over time, it evolved into one of the most innovative technology companies in the world, driving advancements in artificial intelligence, data centers, autonomous vehicles, and high-performance computing.

Today, Nvidia is not just a gaming company — it’s a technology powerhouse shaping the future of AI and computing. That’s why the Nvidia price has gained attention far beyond the stock market — it’s now seen as a barometer for the broader tech industry.

Current Nvidia Price Overview

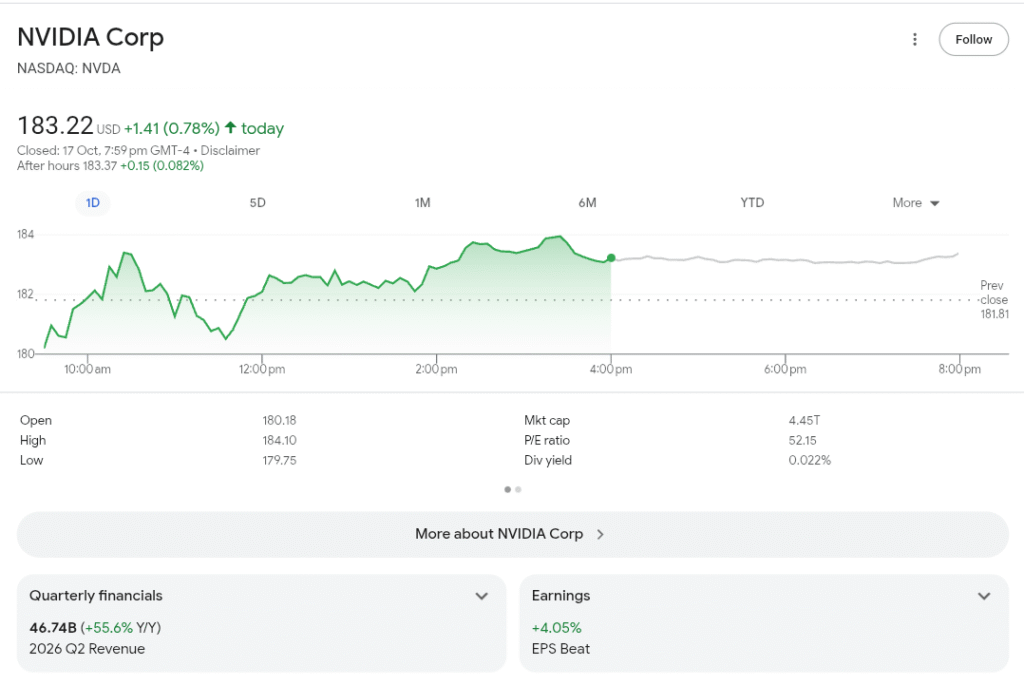

As of the latest market data, the Nvidia price continues to reflect the company’s dominance in the AI chip sector. With strong quarterly earnings, partnerships with leading tech firms, and consistent innovation, Nvidia’s valuation has reached record highs.

However, the stock has also experienced volatility due to broader market conditions, interest rate fluctuations, and investor sentiment in the tech sector. Traders are watching closely for signs of stability as Nvidia balances massive demand for AI chips with potential supply chain constraints.

Why Nvidia Price Has Soared

Several major factors have contributed to the rise in Nvidia’s price over the years:

1. Artificial Intelligence Boom

Nvidia’s chips power most of today’s AI systems, including machine learning, generative AI, and large language models. As companies worldwide invest heavily in AI, demand for Nvidia GPUs like the A100 and H100 continues to surge.

2. Data Center Growth

Data centers represent one of Nvidia’s fastest-growing business segments. As cloud computing and AI workloads expand, companies like Amazon, Google, and Microsoft rely on Nvidia’s high-performance chips to power their systems.

3. Gaming Industry Dominance

Nvidia remains a global leader in gaming graphics cards. With its GeForce RTX series, the company continues to dominate the gaming GPU market, driving strong revenue growth from both PC gamers and professional creators.

4. Strong Financial Performance

Nvidia’s consistent earnings growth, rising profit margins, and impressive revenue numbers have made it a favorite among institutional investors. Its financial stability has been a key factor pushing the Nvidia price higher.

5. Strategic Acquisitions and Partnerships

Nvidia’s strategic acquisitions, like Mellanox Technologies and partnerships in the AI sector, have strengthened its position in the global tech ecosystem.

What Could Affect Nvidia Price in the Future

While the Nvidia price has shown remarkable growth, several factors could influence its future performance:

- Competition: Rivals like AMD, Intel, and emerging AI chip startups are working to capture some of Nvidia’s market share.

- Global Economy: Inflation, interest rates, and geopolitical tensions can impact investor confidence in the tech sector.

- Regulatory Scrutiny: With Nvidia’s rapid rise and dominance, governments are taking a closer look at potential monopolistic practices.

- Supply Chain Issues: Shortages in semiconductor production could limit Nvidia’s ability to meet soaring global demand.

- Market Corrections: High valuations in the tech industry can lead to short-term pullbacks as investors take profits.

Nvidia Price Forecast

Analysts remain largely optimistic about Nvidia’s long-term outlook. Many predict that the Nvidia price could continue to rise as AI adoption accelerates across industries.

According to market forecasts:

- Short-term outlook: Nvidia’s stock may experience volatility due to profit-taking and macroeconomic conditions.

- Medium-term outlook: Continued strength in AI and data center demand could sustain strong revenue growth.

- Long-term outlook: As Nvidia expands into new industries — such as robotics, autonomous vehicles, and healthcare AI — the company’s valuation could continue to climb.

For long-term investors, Nvidia remains one of the most promising tech stocks on the market.

How to Invest in Nvidia

If you’re considering investing in Nvidia, here are a few tips:

- Monitor Earnings Reports: Nvidia’s quarterly reports offer insights into future performance and growth trends.

- Follow Industry News: AI, gaming, and chip industry developments can all influence Nvidia’s price movements.

- Diversify Your Portfolio: While Nvidia is a strong performer, balance your portfolio with other assets to reduce risk.

- Use Technical Analysis: Keep an eye on price charts, moving averages, and trading volumes to identify potential buy or sell opportunities.

Conclusion

The Nvidia price reflects more than just a company’s stock value — it represents the growing influence of artificial intelligence, gaming, and data technology in the global economy. With continued innovation, strong financial performance, and a dominant market position, Nvidia remains a major player in shaping the future of tech.

Whether you’re an investor, a trader, or simply a tech enthusiast, keeping an eye on Nvidia’s price is essential. As the company continues to push the boundaries of what’s possible, its stock remains one of the most exciting — and closely watched — in the world.